It now remains very interesting to watch how the crypto exchange will respond and whether it will indeed abandon the US market, as previously warned in case US federal regulators fail to cooperate.īinance, Coinbase’s main competitor, has also announced that it will vigorously defend its position from the SEC’s bullying, but without referring to any shift in its operations. “You simply can’t ignore the rules because you don’t like them or because you’d prefer different ones: The consequences for the investing public are far too great.” The director of the SEC’s Enforcement Division believes the charges were properly calculated, adding harsh words against Coinbase: These kinds of products must be mandatorily registered with US regulators and obtain the necessary approvals, which Coinbase and Binance have not done. In detail, the company headed by Brian Armstrong allegedly never registered its staking-as-a-service and offered investors sales of unauthorized securities that fall under the heading of security tokens.Īmong them we can observe cryptocurrencies such as SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO.Ī few tokens among those just listed were also reported in yesterday’s lawsuit filed by the SEC against Binance.Īs a reminder, a security token refers to a financial product from which investors expect a financial return, linked primarily to the performance of the company that issues them.

#Coinbase vs binance fees registration#

The US agency’s complaint was formally made in the US District Court for the Southern District of New York, in a document in which Coinbase was cited for violating “ registration provisions.“Īccording to the charges, the exchange failed to fulfill certain obligations prescribed by the Securities Exchange Act of 1934 and the Securities Act of 1933.

New day, new lawsuit filed by the US Securities and Exchange Commission, this time against Coinbase, one of the industry’s most compliant cryptocurrency exchanges. The risk of overly restrictive regulation.Needless to say, Coinbase is the more secure and trustworthy exchange being a publicly listed company in the US while Binance executes first and asks for forgiveness after. Personally, I use both Coinbase and Binance at different times for different purposes.

#Coinbase vs binance fees free#

In terms of fiat deposit and withdrawal options, Coinbase supports three fiat currencies tailored for the US and Europe with low cost to free deposit options while Binance supports 26 fiat currencies and several deposit methods. This wider product range has also allowed Binance to push down on trading fees which is harder for Coinbase to do with a mainly retail friendly userbase.Īs such, the fees charged by Coinbase of 0.40% for makers and 0.60% for takers are much higher than the 0.10% charged by Binance for makers and takers. This means that Binance is both available in more countries, offers more features and has a larger selection of cryptocurrencies.

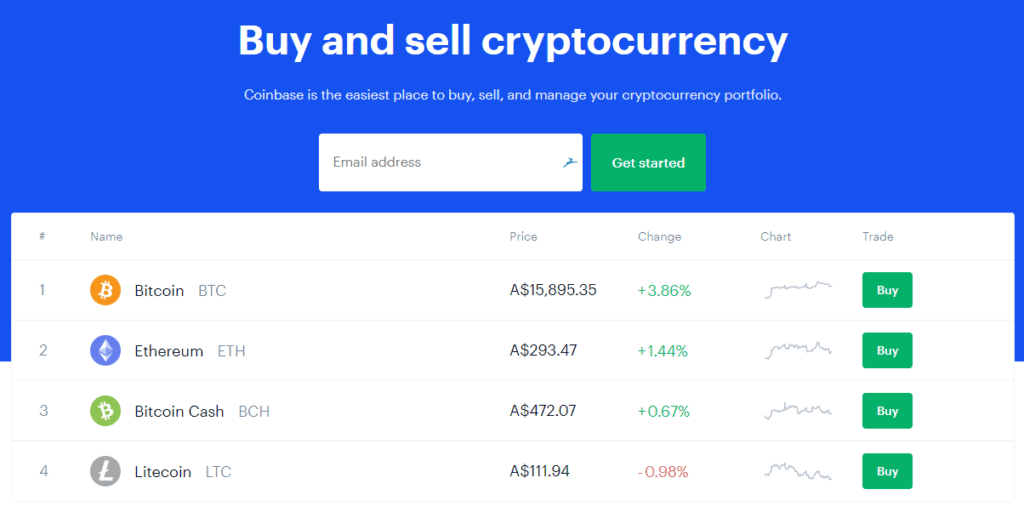

Binance as an offshore entity has much less regulatory scrutiny and as such offers a much wider range of products. Coinbase as a US entity is more constrained than Binance in terms of the product and services that it can offer it's users. Coinbase and Binance are two of the most popular cryptocurrency exchanges in the world.

0 kommentar(er)

0 kommentar(er)